Let’s Be Real

Ignoring your student loans feels easier than facing them. Out of sight, out of mind, right? Until a “payment due” email hits your inbox, your stomach drops, and you suddenly remember: oh right, that debt still exists.

If this sounds oddly familiar, take a deep breath. You’re not behind. You’re not irresponsible. You’re just overwhelmed, and that’s okay. No one teaches this stuff in school, yet here you are, expected to make life-changing financial decisions while still figuring out your LinkedIn headline. (I’ve only changed mine like 10 times this week. ha.)

So let’s talk about how to handle your loans calmly, clearly, and confidently. Plus, pair it with real steps that’ll help you get back in control.

Step 1: Face the Numbers

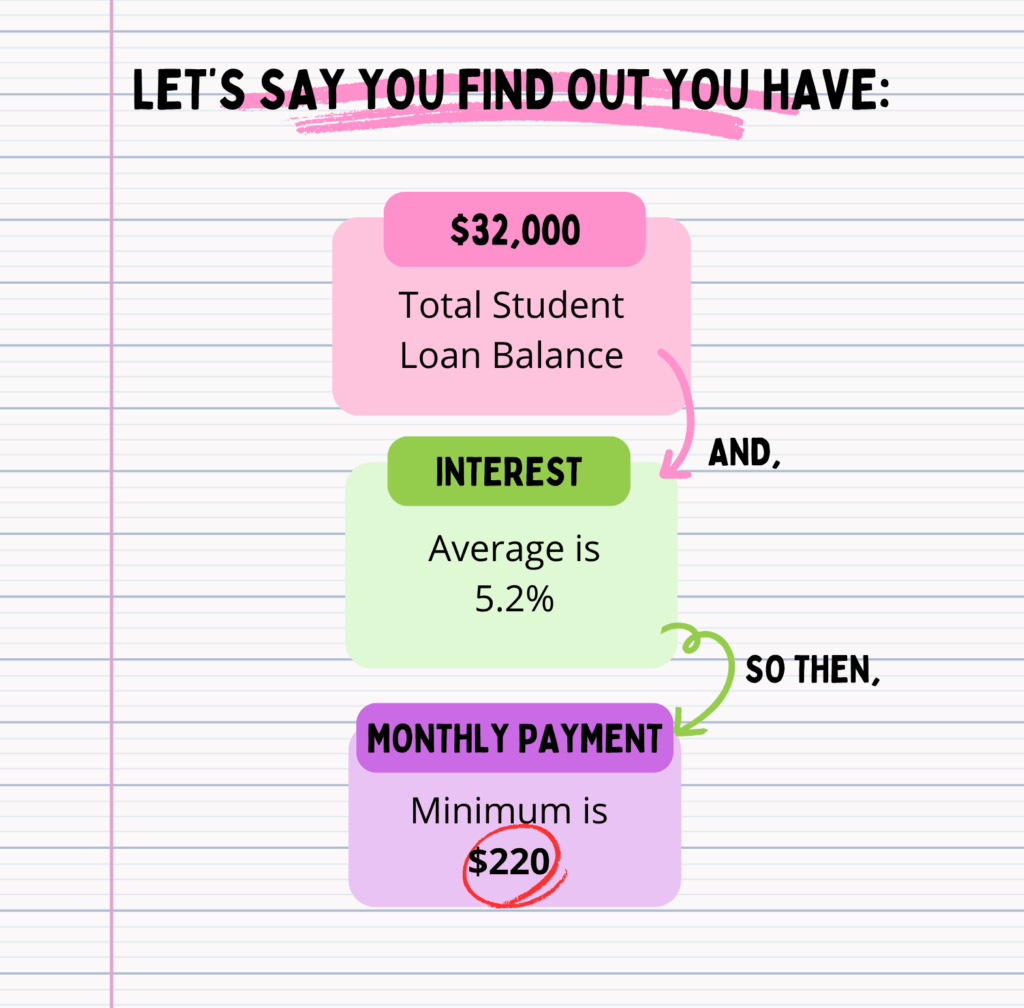

The first step is simple, but not easy: you need to know what you actually owe.

What to Do

- 1. Log in to StudentAid.gov if your loans are federal.

- 1a. For private loans, check your lender’s website or credit report.

- 2. Then, write down the following:

- – Total balance

- – Interest rate

- – Loan type (federal vs. private)

- – Monthly minimum payment

- – Loan servicer contact info

Put everything in one place, like a notes app, Google Sheet, or on a piece of paper. The goal is to replace your dread with the actual data.

Congratulations. You’ve just done the hardest part—facing it.

PROS

- – You finally have clarity.

- – You can make real plans based on facts, not fear.

CONS

- – The first look might sting. You’ll feel that “ugh” wave of reality. But, it passes fast. And that’s speaking from experience, unfortunately :’)

Step 2: Understand Your Repayment Options

Now that you know your numbers, it’s time to pick your repayment plan. A nicer way to think of this is as an adult buffet. You get to choose your plan! (Except instead of yummy foods, it’s ways to pay off debt… haha… *cries*)

Federal Loan Options

Federal loans come with flexibility. Here’s a breakdown using our earlier example:

| Plan Type | Best For | Payment Style | Example |

|---|---|---|---|

| Standard (10-Year Plan) | Stable income, want debt gone fast | Fixed payments | $220/month, paid off in 10 years |

| ***Income-Driven Repayment (SAVE, PAYE, IBR, REPAYE) | Low to moderate income | Based on income and family size | $120/month, adjusts yearly |

| Graduated or Extended Plan | Need smaller payments now | Starts low, grows over time | $150 now, increases every 2 years |

Example

If you earn around $40,000 a year, you might qualify for a SAVE plan (formerly REPAYE) that cuts your monthly payment nearly in half and could forgive remaining debt after 20–25 years.***

PROS

- – Protects you from falling behind when income is low.

- – Makes your loans less intimidating and more manageable.

- – Can qualify for loan forgiveness over time.

CONS

- – You might pay more in interest long-term.

- – You have to re-certify your income annually.

- – It doesn’t erase the debt overnight (sadly).

Quick Word Check-in (click on the word for definition)

Forgiveness

What’s left after 20-25 years of consistent payment may be wiped clean (though taxes may apply).

Income recertification

Each year, you’ll update your income so your payment stays fair.

Private Loans

Private loans don’t have the same flexibility. But if your credit score has improved, refinancing might help lower your interest rate.

Pro Tip: Only refinance if you have all private loans or you’re sure you’ll never need federal protections again. Once you refinance, you can’t go back!

*** SAVE Plan: What’s Changing ⬅️ Click to find out!

Here are the major changes and problems you should know about:

A federal appeals court ruled against parts of the SAVE Plan, which has slowed or halted certain features of it. Because of this, the U.S. Department of Education (ED) has advised some borrowers to move out of SAVE and into other plans.

For many borrowers enrolled in SAVE, interest that had been paused is now being restarted as of August 1, 2025. That means your debt could grow again.

Legislation under the current administration introduces new repayment plans (like the Repayment Assistance Plan (RAP)) and begins phasing out SAVE and other income-driven plans for people who take out new loans in the future.

After July 1, 2026, new federal loans might only have options like the standard plan + RAP (for new borrowers).

What This Means for You (as a Borrower)

If you’re already in SAVE:

You’re not immediately doomed, but your plan has more risk now (interest resuming, features frozen). Consider assessing whether another plan might better protect you. If you switch plans, or had payments in certain forbearances, your progression toward forgiveness might be affected.

If you’re not yet enrolled or will take out new loans:

SAVE may no longer be a viable future option for new loans after the cutoff date. So you’ll want to look into what the RAP or other plans will offer.

Regardless:

Stay on top of communications from your loan servicer and the Education Department. Track your payments, interest, and whether your plan still matches your income and goals. Be ready to adjust if legal/administrative changes continue.

Bottom Line

Yes, the SAVE Plan did get significant changes (and uncertainties) under the current administration. Some of its benefits are frozen or being phased out, interest is back for many, and future repayment options are being restructured. You should treat your SAVE enrollment (or future consideration) with awareness, not panic. But please aware that the rules are shifting. Once more details are confirmed, I’ll break it all down in a full deep-dive post, so stay tuned!

Step 3: Pick a Payoff Method That Matches Your Personality.

Here’s where we get strategic, and maybe even a little fun. There’s no “one right way” to pay off loans. The best plan is the one you’ll actually stick with.

Option 1: The Avalanche Method

- What it is: Pay off loans with the highest interest rate first.

- Why it works: You save the most money long-term.

- Example: If you have loans at 7%, 5%, and 4%, you attack the 7% one first.

PROS

- – Saves more money overall.

- – Mathematically, the smartest strategy.

CONS

- – It can take longer to feel progress. You might lose motivation before the first win.

Option 2: The Snowball Method

- What it is: Pay off the smallest balance first, then move to the next.

- Why it works: You get quick wins, which build momentum.

- Example: Pay off a $2,000 loan before a $12,000 one, even if interest is lower.

PROS

- – Great for motivation and emotional wins.

- – Helps you stay consistent when money feels tight.

CONS

- – You’ll pay a bit more in interest overall.

Option 3: Minimum Only (Stability Mode)

- What it is: Just make minimum payments while you get your finances together.

- Why it works: You stay current and protect your credit.

- When to use: During unstable times (job change, new baby, burnout, etc.)

PROS

- – Keeps your account(s) in good standing.

- – Gives you mental space to focus on stability.

CONS

- – Your balance will drop slowly.

- – Not ideal for long-term payoff goals.

Step 4: Automate It So You Can Forget About It (on Purpose)

Once you’ve chosen your repayment plan and strategy, automate your payments. Set everything you can on autopilot so you can go live your life!

How to Do It

- Log into your loan servicer account.

- Turn on AutoPay from your checking account.

- *Bonus: Most lenders give a 0.25% interest discount just for automating!

PROS

- – You’ll never miss a payment (and avoid late fees).

- – One less thing to think about each month.

- – Builds healthy habits passively.

CONS

- – Requires stable income.

- – Make sure the account you’re pulling from always has enough funds. Some lenders have chargeback fees if there is insufficient funds and they are unable to take the payment.

Step 5: Add Extra Payments (When Life Lets You Breathe)

When you have a little extra (like a bonus, tax refund, or side hustle money) consider throwing it at your loans. Not literally, figuratively. (In case you needed the clarification, lol)

Example

If you add just $50 extra per month on a $30,000 loan at 5%, you could finish a full year early and save over $1,000 in interest.

Tips

- Round up your payments (e.g., $220 → $250).

- Use windfalls (raises, gifts, tax refunds).

- Make sure to tell your servicer to apply extras to the principal, not future payments. This is KEY. Lenders can be sneaky.

PROS

- – Shortens your repayment timeline.

- – Builds a sense of progress and momentum.

CONS

- – Only works when you have room in your budget, please DO NOT drain your emergency fund for it.

Step 6: Celebrate Milestones Like the Responsible Queen You Are

This part is important. You’re doing emotional labor every time you face your finances, and that deserves recognition. 💕

How to Celebrate

- Made your first payment? Treat yourself to a fancy coffee.

- Paid off a whole loan? Dinner out.

- Hit the halfway point? Spa night or self-care splurge.

You’re rewiring your relationship with money, from avoidance to confidence. Every payment is proof you’re doing the thing.

Quick Recap Checklist

Here’s your no-stress student loan checklist, save it, print it, tattoo it (okay, maybe not that last one):

- ☐ I know how much I owe

- ☐ I understand my interest rates

- ☐ I picked a repayment plan that fits my income

- ☐ I chose a payoff strategy that fits my personality

- ☐ I automated my payments

- ☐ I celebrate progress regularly

Even if you only check off the first two boxes today, that’s still progress. You’ve gone from ignoring your loans to actively managing them, and that’s amazing.

Real Talk: Why You Probably Avoided Your Loans (and Why That’s Okay)

Let’s name the emotional side: fear, shame, confusion, burnout. They all play a role. But debt isn’t a moral failure, it’s a financial tool you’re learning to manage.

You’re not “bad with money.” You’re just human in a system that never taught you how to handle it.

And now? You’re teaching yourself.

That’s power.

The Takeaway

You don’t have to fix everything this week. Just take one step:

- 1. Log in.

- 2. Look at your balance.

- 3. Pick one repayment option to explore.

That’s it. You’ll be amazed how much calmer you feel once you stop running from it.

Progress doesn’t come from panic. It comes from small, steady moves that add up. Just like interest, but in your favor this time.

Ready for Your Next Step?

You’ve faced your student loans like a champ. Now, it’s time to protect your peace (and your wallet).

👉 Next up: Emergency Funds: How to Build One When You’re Tired, Underpaid, and Craving Brunch — a realistic guide to creating your financial safety net without giving up joy or coffee.